The Jabal Sahabiyah tender area consists of three contiguous Exploration Licenses and was awarded to Royal Road Arabia (a joint-venture company held 50-50% between Royal Road Minerals and MIDU Ltd) at the Future Minerals Forum, January 2024. The licenses cover approximately 284 square kilometers and are located in the Asir Province of the Kingdom of Saudi Arabia, within the geologically prospective Nabitah-Tathlith belt.

Jabal Sahabiyah is a district of drill-ready zinc-gold (± copper, silver) skarn bodies and gold-bearing quartz veins located around and related to a central intrusive core.

The Jabal Sahabiyah Exploration tender consisting of three contiguous Exploration Licenses was awarded to Royal Road Arabia in a competitive Licensing Round in January of 2024. The license areas are approximately 284 square kilometers in areal extent and located in Asir Province of the Kingdom of Saudi Arabia within the prospective Nabitah-Tathlith belt.

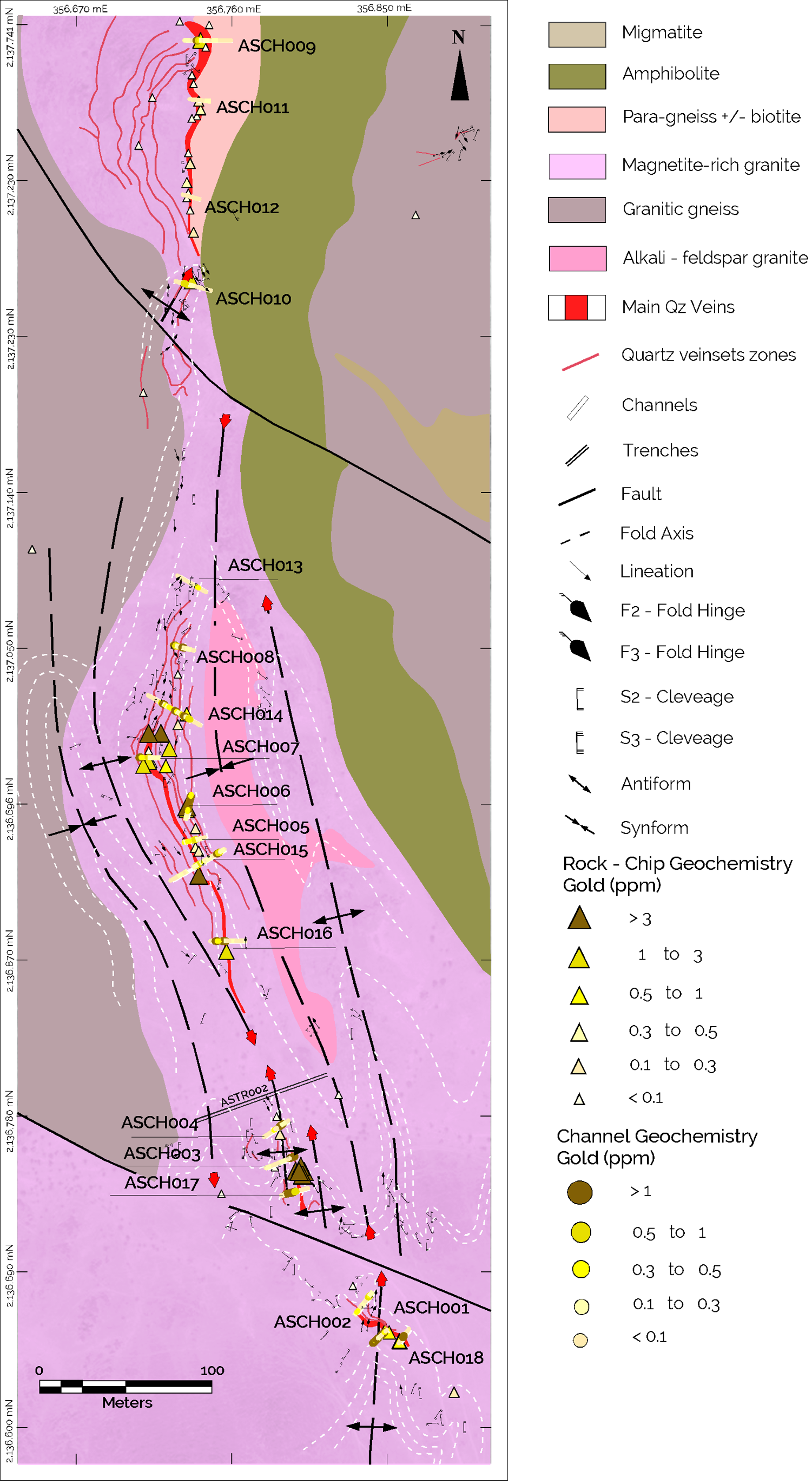

Mineralization at Jabal Sahabiyah is hosted in poly-deformed amphibolite-facies rocks located around a central intrusive “core”. Mineralization is zinc-gold (± copper, silver) skarn and vein-gold in style. Several gossans were scout-drilled by Riofinex (a subsidiary of Rio Tinto Zinc) in the late 1970’s and vein-gold occurrences were scout-drilled by Ma’aden in 2007.

Royal Road Arabia has completed an initial first-pass scout drilling programme of approximately 2,500 metres, systematically testing multiple polymetallic skarn and gold-bearing vein

targets defined by geological mapping, trenching and channel sampling. This programme confirmed the presence of both base and precious metal mineralisation across several prospect areas and materially advanced the geological understanding of the project.

Both prospects have returned encouraging surface results, including gold-bearing channel samples, and host laterally extensive mineralised systems with kilometre-scale strike potential and, in the case of Al Habah, significant aggregate vein thicknesses.

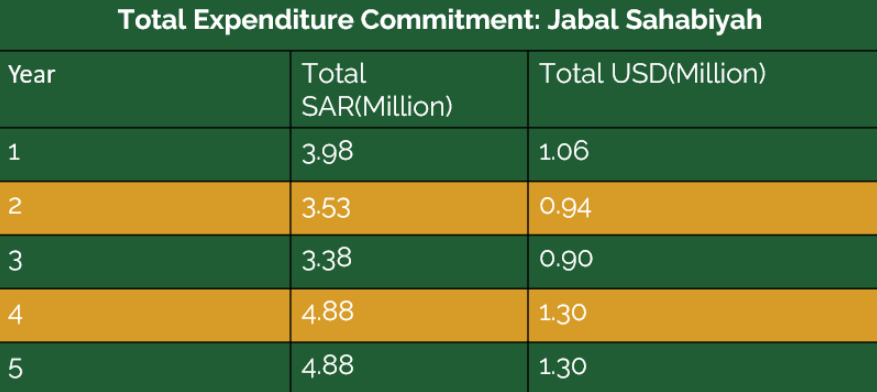

For the Jabal Sahabiyah project, Royal Road has committed to an expenditure of 1.06M USD in Year 1, 0.94M in Year 2 and 0.9M in Year 3(The project is currently in year 2). Full expenditure commitment can be found below:

January 2026 - Reverse circulation drilling at the Al Habah and Ash Shajjah(See image below) prospects in order to test sheeted gold-vein and gold mineralized vein breccia systems is ongoing, although rock chip channel results have returned positively, including 10 meters at 2.2 grams per tonne gold and 6 meters at 5.0 grams per tonne gold from Ash Shajjah (see press release November 17 2025).

ISO 14001 Certification

Royal Road Arabia has also recently achieved ISO 14001:2015 certification, confirming the company's commitment to environmental responsibility and sustainable practices. This compliments the existing certifications of RRA detailed adjacent:

• Occupational Health & Safety Management System (OHSMS)

Demonstrates the company’s commitment to maintaining a safe and healthy working environment.

• Quality Control Management System (QCMS)

Reflects the company’s dedication to quality assurance and operational excellence.

• Customer Satisfaction Assurance Management System (CSAMS)

Highlights the company’s focus on customer satisfaction and continuous improvement.

Additional Exploration Licenses

Royal Road Arabia has also been awarded 7 additional exploration licenses covering three areas(As Saq'ah, Jabal Musamah and Al Neqrah):

Grant of full title to the licenses is conditional upon submission and approval of detailed work programs together with environmental and social management plans by the Ministry of Industry and Mineral Resources. This approval process is expected to be completed in early 2026.

•As Saq’ah:

-Preliminary reconnaissance sampling returned rock-chip assays of up to 51.0g/t gold and 2.41% copper

-Mineralization associated with a northeast-trending fault zone

•Jabal Musamah:

-Northeast – preliminary sampling returning assays up to 3.3g/t gold (mean: 1.39g/t)

-Southeast – gold mineralization is interpreted to be intrusion-related, returned values up to 6.3g/t (mean: 1.19g/t)

•Al Neqrah:

-Significant greenfields exploration opportunity

-Strong geochemical and geophysical prospectivity

-Broad low-magnetic response interpreted to represent the same geological sequence that hosts the Bulghah Gold Mine

The upcoming focus is an initial, aggressive “drill or drop” exploration campaign across the three project areas, combining license-scale geological mapping and prospecting with systematic sampling, trenching, soil geochemistry and drone-based magnetic surveys to rapidly delineate priority drill targets.

Royal Road will continue to evaluate exploration opportunities in KSA, including those expected to be offered in Tender Round 10.

The Kingdom of Saudi Arabia has embarked on an ambitious initiative of economic and social reform, it is using its investment power to create a more diverse and sustainable economy. The country wishes to increase non-oil GDP from 16% to 50% and the mining sector is seen as a key component of this goal. Saudi Arabia offers:

Royal Road benefits from local partnership, in-country presence, and alignment with national development objectives, supporting long-term project advancement.

Copyright 2026. Royal Road. All rights reserved